(Bloomberg) — Slowing sales at Topgolf Callaway Brands Corp.’s namesake driving ranges and a hefty debt load that threatens to frighten off buyers spurred Raymond James to slash the company’s rating.

Analyst Joseph Altobello double downgraded Topgolf Callaway, cutting his recommendation to underperform from outperform, making him just the second analyst among the 14 tracked by Bloomberg to back selling the shares. After notching a 1.6% slide Friday, the stock’s slump for the year deepened to 22%.

“Acquisitions have led to a bloated balance sheet,” Altobello said. The company is conducting a strategic review of its Topgolf driving-range chain, including a potential spinoff, but he worries that such a deal might come “too late.”

The downgrade follows just weeks after the company reported lackluster second-quarter revenue on weaker-than-expected same-venue sales at its Topgolf chain, and cut its revenue and profit forecasts for the full year.

“Our rating largely reflects the recent deterioration in same-venue sales at Topgolf, and while we applaud management’s openness to a potential spinoff of the business, the company’s levered balance sheet appears to limit its opportunities,” Altobello wrote in a note to clients. “Investors should avoid the shares until we gain greater clarity on both situations.”

To Altobello, the sales trends raise questions about who would step in as a buyer of the Topgolf business. “We don’t think either private equity or strategic buyers such as Bowlero, Dave & Buster’s or SeaWorld would necessarily be interested given these weakening trends and the significant venue build costs,” he said.

Worse yet, even if the firm is able to successfully spin off Topgolf from its legacy golf business, the likelihood that it will be able recoup its initial investment in the chain is low, according to Altobello. Callaway Golf Co. bought the remainder of Topgolf Entertainment Group in late 2020, in a deal that valued the driving-range chain at about $2 billion.

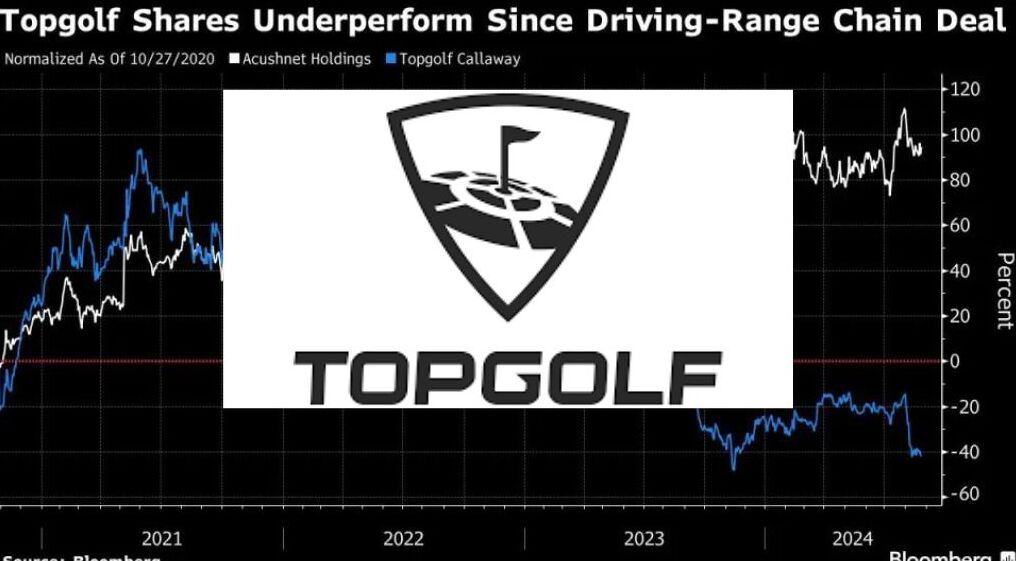

In the roughly four years since the Topgolf deal was announced — during what Altobello says was arguably the “greatest period in the history of the sport/industry” — shares of the firm have fallen more than 40%. Over that same stretch, Acushnet Holdings Corp., which owns brands like Titleist and FootJoy, has seen its shares nearly double.