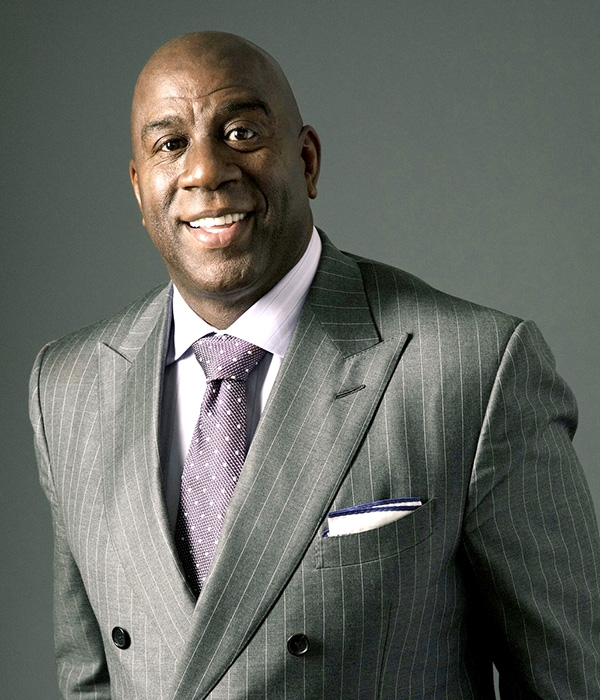

May 18, 2020 —Earvin “Magic” Johnson, former Los Angeles Lakers guard and team president announced that his life insurance company will provide $100 million for women- and minority-owned small businesses as part of the Paycheck Protection Program (PPP).

Johnson, the owner of EquiTrust, the nation’s largest minority-owned insurance company, will partner with MBE Capital Partners, a Latino-owned company, to provide supply chain finance solutions for Fortune 500 companies and their suppliers.

Those interested in applying for the loans from EquiTrust and MBE Capital can apply here.

According to Forbes, Johnson was motivated after hearing reports of minority- and women-owned businesses being shut out of the PPP. At the same time, Johnson discovered the Lakers organization applied for and received $4.6 million from the program. The Lakers, worth an estimated $4.6 billion, returned the money after public pressure.

“We knew why the money was gone and couldn’t trickle down to small businesses, especially small minority businesses, because they didn’t have those great relationships with the banks,” Johnson told the Wall Street Journal. “So this was easy for us to understand.”

MBE’s Chief Executive, Rafael Martinez, said he received complaints from clients who couldn’t get loans from the PPP’s first round of funding. It was later reported that large banks prioritized existing relationships and large corporations before focusing on smaller and minority businesses.

According to the Center for Responsible Lending, up to 90% of businesses owned by people of color have been, or will likely be, shut out of the PPP program.

Martinez and Johnson also announced the partnership on MSNBC’s Politics Nation with Al Sharpton.

MBE Capital is designed to help small and diverse businesses take advantage of this latest round of PPP funding. The company can process up to 5,000 loans per day, utilizing end-to-end online technology to accept, underwrite, and transmit the applications to the SBA.

After feeling ignored in the first round of PPP loans, African American-owned banks and businesses have found ways to team up to make sure it doesn’t happen again.