A PGA Tour policy board member with a long-standing tenure has resigned in response to the framework agreement between the Tour, DP World Tour, and Saudi Arabia’s Public Investment Fund (PIF) to establish a new global golf entity.

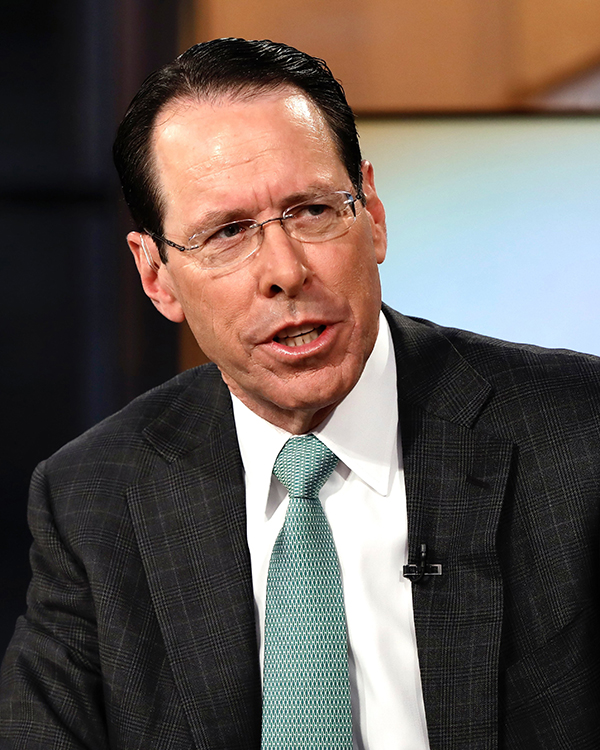

Randall Stephenson, a former AT&T executive, stepped down as an independent director due to “serious concerns” regarding the proposed deal, which still awaits approval from the Tour’s 10-member board. Although Stephenson had been on the board since 2012, he expressed his inability to objectively evaluate or support the framework agreement, particularly considering the U.S. intelligence report on Jamal Khashoggi from 2018. In a letter obtained by the Washington Post, Stephenson stated, “I joined this board 12 years ago to serve the best players in the world and to expand the virtues of sportsmanship instilled through the game of golf. I hope, as this board moves forward, it will comprehensively rethink its governance model and keep its options open to evaluate alternative sources of capital beyond the current framework agreement.”

PGA Tour members were informed of Stephenson’s resignation on Sunday night by Tyler Dennis and Ron Price, who are acting in the absence of PGA Tour Commissioner Jay Monahan due to an undisclosed health issue.

Stephenson had initially planned to resign within a week of the deal’s announcement but extended his tenure after learning of Monahan’s temporary departure. On Friday, Golfweek reported that Monahan would be returning to his position, with the Tour confirming his comeback on July 17. As per PGA Tour bylaws, the four remaining independent directors on the board, in consultation with the five player directors, are responsible for selecting Stephenson’s replacement, who must be “a public figure with a demonstrated interest in golf.” No specific timeline has been provided for the appointment.

On Tuesday, the Senate Permanent Subcommittee on Investigations, led by Senator Richard Blumenthal (D-Conn.), is scheduled to hold a hearing regarding concerns surrounding “the Saudi government’s role in influencing this effort and the risks posed by a foreign government entity assuming control over a cherished American institution.”

Blumenthal expressed the committee’s goal of uncovering the facts about the PGA Tour’s deal with the Saudi Public Investment Fund and its implications for the future of the sport. The committee invited PGA Tour Commissioner Jay Monahan, LIV Golf League CEO and Commissioner Greg Norman, and PIF Governor Yasir Al-Rumayyan to testify, emphasizing the public’s right to information on the structure and governance of the new entity.

Jimmy Dunne, a policy board member involved in constructing the deal, and Ron Price, the Tour’s Chief Operating Officer, will also be present at the hearing.

The PGA Tour, DP World Tour, and PIF announced the framework for the new global golf entity on June 6, following the signing of the deal on May 30. The U.S. Department of Justice is also conducting an investigation into the proposed agreement.

As part of the framework, both the PGA Tour and LIV Golf dropped their respective pending lawsuits. However, the New York Times has filed a motion to unseal all documents related to LIV’s claim and the Tour’s counterclaim, citing the public’s First Amendment and common law rights to access public records.